LOOKING FOR AN ALTERNATIVE TO PROPERTY INVESTMENT?

The Above Shows A Typical Development

Fund & Develop With Us | Fixed Return | Asset Backed | Defined Exit Strategy

Fund & Develop With Us is a program we operate whereby our clients can get all the benefits of property development via highly experienced professionals, who find, vet and pre-sell development projects.

Project Partners: McDonalds | Starbucks | Costa Coffee | Greggs | KFC | Burger King | Euro Petrol Stations |

The Projects are all pre-sold to the above investment partners before the developments are acquired.

There are several reasons why our clients prefer our fixed return investments which are provided via our Fund & Develop With Us program.

Set Process_

Sites identified

Negotiations begin

Sites offered to end partners

Partners sign LOI to purchase the property or to let for 25 years

Site Acquired

Site Developed

Site handed over to end purchaser.

All projects are pre-sold or pre-let before being acquired.

Our expertise lies in providing investments that are income-generating from day one. Our goal is to provide a seamless and stress-free experience, and our team of seasoned professionals is available to guide investors at every step of the way.

With property averaging less than 4.5% growth per annum many investors are looking for safer alternative investments to Property, without any of the associated costs or pitfalls.

Investors can now use structured investments to fund the historically reliable property market by lending secured capital to property developers.

Ask yourself? What are you looking for in an investment opportunity?

A HIGH-YIELD FIXED RETURN:

Investment Highlights_

Short Term - 2 Year Term

Fixed Return or Fixed Income Options

Low Entry - From £10,000

High Yielding

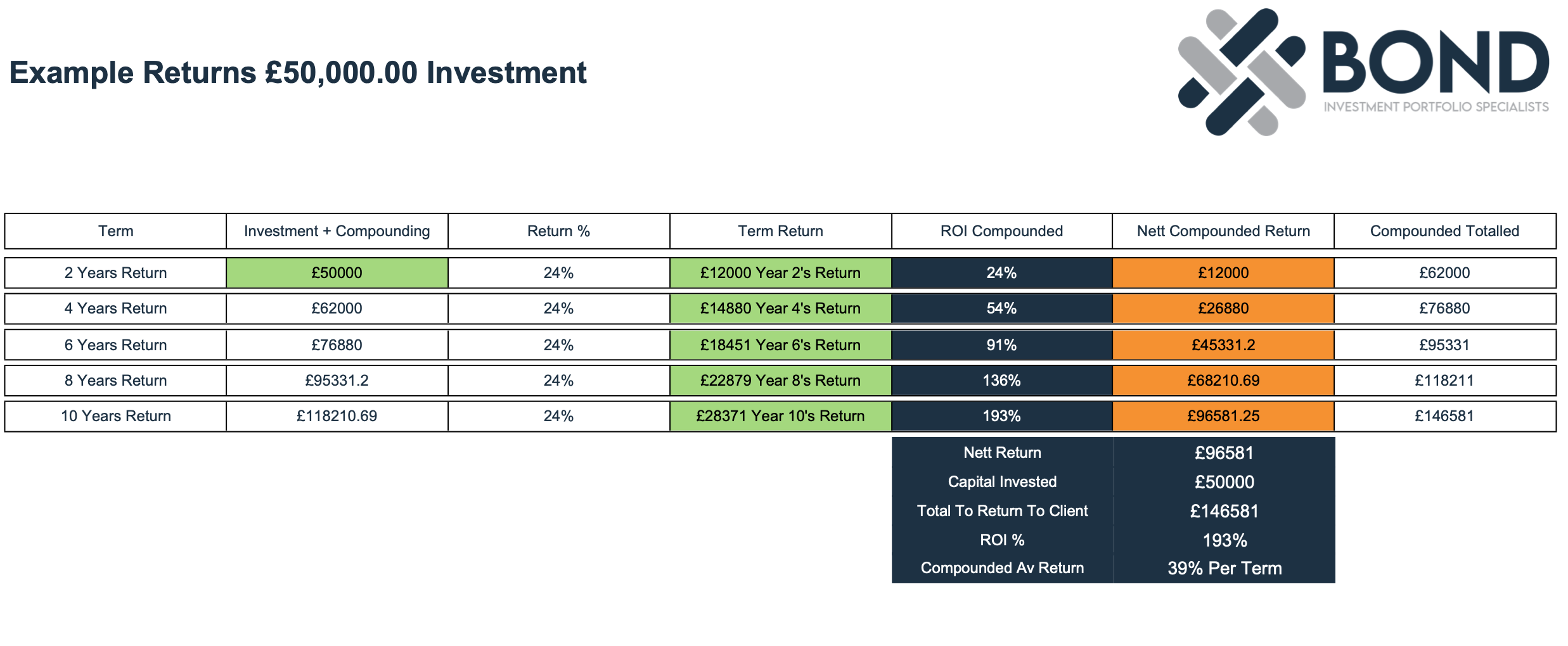

10% to 12% Per Annum (20% to 24% Combined)

No Fees like with property

No Ongoing Costs like with property

No tenants, no voids and no damages to deal with

Reinvestment Available - 80% of clients reinvest

No Volatility like Stocks, Shares and Crypto-Currencies

Paid biannually or at the end of the two-year investment period

SASS Applicable, invest through your pension

Provides Portfolio Diversification

Typically Higher Return on investment than Property, Bonds & ISA's

Loan note holders are protected by the independent security trustee.

Security is provided because Blue Water Capital acts as security trustee`and holds a debenture over the company and assets in favour of all loan note holders.

Developer Highlights_

25 Years of trading history

Provide A Defined Exit Strategy - developments are already pre-sold to McDonald’s, Lidl, Subway, Greggs, Starbucks plus many other Tier One companies before a site is purchased .

Secured, Asset-Backed, Investment

They have already paid back over 10 Million Pounds to investors

-

A yield investment is an investment that generates regular income or fixed return for the investor in the form of interest, dividends, or other payouts. The term "yield" refers to the return that an investor receives on their investment.

-

A typical development finance loan note period is 2-3 years, this is because in order for a developer to be able to calculate the return they can pay to an investor they need to know the period they will have the client’s funds. We believe 2-3 years provides both client and developer the period required to create a good return for both parties.

-

Maximize your investment potential with yield investing. Bond IPS offers strong alternatives to traditional property investment with Fixed Returns and security. Choose from three investment options: full asset ownership, shared ownership, or developer finance loan note. All options offer fixed returns of 8-12% p.a. with 25-year fully repairing leases, and no mortgage, interest, debt, or hidden fees. Invest in a range of vetted assets in the North West of England and benefit from our team of experts expertise.

-

At Bond IPS we work with developers who have years of experience in their sectors with some having over 25 years. By providing development finance investors can benefit from strong returns without the pitfalls of property ownership.

“Compound Interest is the Eighth Wonder Of The World. He Who Understands it, Earns It; He Who Doesn’t. Pays It”

— Albert Einstein